News

Applied Consulting vs. Hiring a New Employee

How does hiring an Applied Engineering consultant compare to hiring a new employee, and which one provides the best value for your company? This question was presented to Applied when a company asked for a proposal for engineering services. The company asked, “How do I justify the cost of hiring … Read More

PRESS RELEASE: Applied named one of 50 Best Places to Work for 10th year

We are thrilled to announce that Applied has been named one of Prairie Business Magazine’s 50 Best Places to Work for our 10th time! More than 1,700 nominations were submitted for a total of 86 companies in North Dakota, South Dakota, and Minnesota – with companies ranging from small businesses … Read More

Engineering Solutions “On a Stick”

The Minnesota State Fair is finally here! The fair known for it’s seemingly limitless array of food-on-a-stick. At Applied, we believe in making complex manufacturing solutions as convenient and enjoyable as your favorite fair foods. And we do so in a fast, easy, and affordable manner. You may know that … Read More

STUDENTS: Join Us at Upcoming Career Fairs

🚨 ATTENTION STUDENTS!🚨 We are going on the road this month to attend various university career fairs. Come say hello and see what a future with Applied has to offer! University of Minnesota Tuesday, February 6th, 2024 12:00pm – 5:00pm More Info North Dakota State University Wednesday, February 7th, 2024 … Read More

Top 10 Reasons to Use Applied Engineering

There are countless reasons to use Applied Engineering to solve your manufacturing, engineering, and technology challenges. Here are the top ten: Experience: We have a large staff of engineers, designers, and technicians experienced in product design, testing, and manufacturing. Flexibility: We’ll work at your site or at ours, on a … Read More

PRESS RELEASE: Applied Receives 50 Best Places to Work Award

We are pleased to announce that Applied Engineering has been named one of Prairie Business Magazine’s 50 Best Places to Work for our 9th year! More than 1,500 nominations were submitted, with employees mentioning workplace culture, opportunities for employee growth, teamwork and individual responsibility, and employee morale as reasons their … Read More

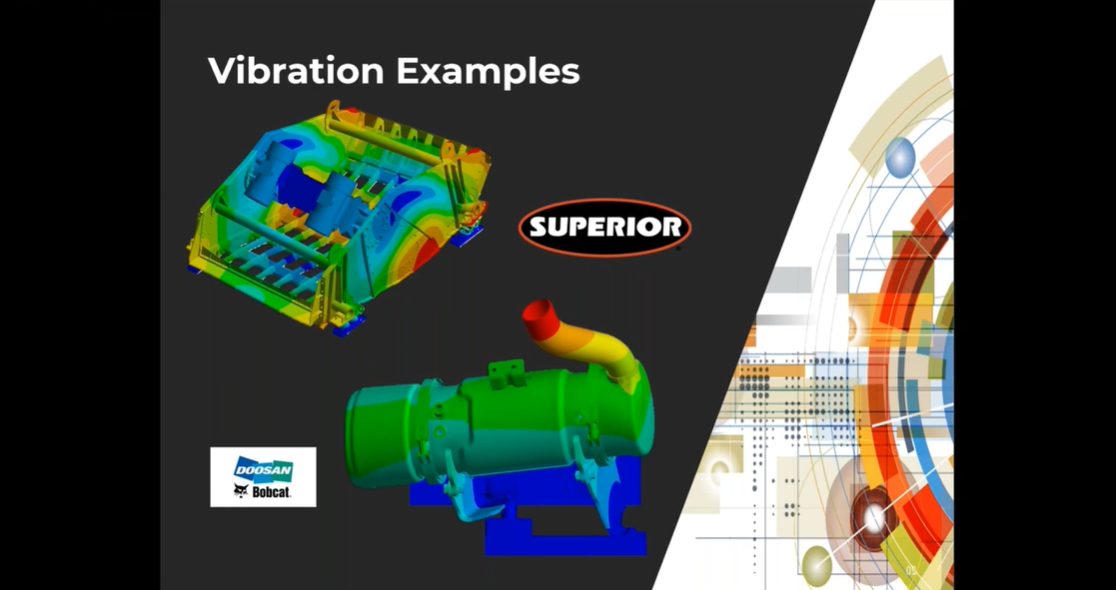

Get the Most Out of Your Products with Advanced Analysis

Looking to improve product performance and reduce costs? Look no further. Applied Engineering has a highly knowledgeable analysis group experienced in multiple facets of structural and computational dynamics. Leveraging these technologies is critical in obtaining accurate answers in many applications. We have the tools and experience to take the understanding … Read More

PRESS RELEASE: Applied Engineering Named One of 50 Best Places to Work

We are proud to announce that Applied Engineering has been named one of Prairie Business Magazine’s 50 Best Places to Work for our 8th year! There were nearly 1,700 nominations this year, with employees citing workplace culture, opportunities for employee growth, teamwork and individual responsibility, and employee morale as reasons … Read More

Applied Fits Your Custom Software Needs

Applied Engineering helps businesses design and develop cutting-edge, innovative technologies fast and affordably. Applied Engineering has a full staff of talented people who possess a wide range of technical skills to help you achieve your goals. We’ve helped customers create custom online libraries, campsite reservation software, automate design and manufacturing … Read More

Did you miss Applied Day 2022?

No worries! We’ve recorded each session so you can watch, rewatch, or share them anytime: 3D Printing Applications for Engineering & Architecture Join Print & Image Operations Director, Paul Bartron, and Professional Services Director, Steve Thompson, as they discuss what 3D printing is, types of 3D printing, and how it … Read More