Leveraging Applied Consulting or Hiring a New Employee

Applied Consulting VS Hiring a New Employee

Which one would be more cost effective to add to your business mix? If you said a new employee, you may be mistaken.

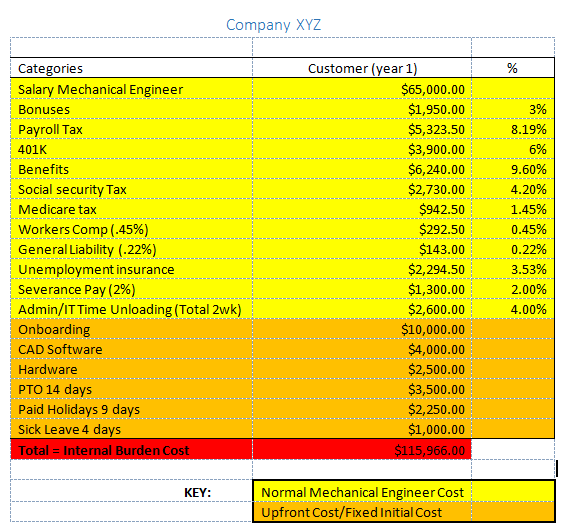

This question was presented to Applied when a company asked for a quote on a service. They were given a quote of $69 an hour. Company XYZ asked “How do I justify the cost of hiring your services over hiring a new employee to do the same task?” Other companies have probably asked this same questions during similar situations, so Applied went to work to show the value of their services with a detailed breakdown of the benefits when hiring them to consult for a customer.

Most companies think that adding a new employee would be less expensive due to the lower hourly wages compared to a consultants hourly fee, but there are other factors that are not considered that affect an employee’s wage.

Calculating the true cost of an employee can be challenging. Employee payroll and employee-related costs comprise an extremely large portion of most business entities’ non-recoverable cash outlay. Like most businesses, you are probably in fairly close touch with each employee’s hourly wage or salary, and may have a good idea of approximately what payroll taxes cost. But you may not have taken the time to research and compute all of the additional “hidden” or internal burden cost associated with each individual, including but not limited to bonuses, payroll taxes, 401K, benefits, social security tax, Medicare tax, workers composition, general liability, unemployment insurance, severance pay, uniforms or special work clothes, usage of equipment, training, work supplies, office space, administration/IT time unloading, onboarding, CAD software, hardware, PTO, paid holidays, and sick leave.

Did some of those simple items get forgotten when you were calculating what your employee cost?

Applied identifies these actual cost of an employee an “internal burden cost”. Which means the indirect costs associated with employees, over and above gross compensation or payroll costs. The burden cost provides a truer picture of total labor expenses than payroll costs alone. The internal burden cost explains many of the expenditures associated with the “hidden costs” that are not readily apparent. Since total labor costs, including the internal burden cost, may be as much as 50% higher than payroll costs alone, it is necessary to calculate the burden cost accurately to get a better picture of profitability.

Let’s look at an example of what a new employee could cost. Wendy’s hourly compensation is $17.00 per hour or $35,360 gross annual payroll.

As Wendy’s employer, you look over all the additional annualized cost attached to her position:

• $3,248 for payroll taxes (based on 3% state unemployment)

• $3,536 for workers compensation insurance (at $10 per $100)

• $4,800 for health insurance ($400 per month)

• $1,060 retirement benefits (3% of compensation)

• $960 for cell, telephone and/or Internet costs ($80 per month)

• $100 in uniforms or for office workers an equivalent amount in kitchen supplies

• $6,000 in company vehicle usage or for office workers an equivalent amount in equipment usage and maintenance as well as office space

• $700 estimated annual bonus

• $200 employee-paid meals, parties and entertainment

• $250 in training fees, seminars, etc.

Total additional cost: $20,854*

Next, let’s determine how many hours Wendy is potentially available for company project work. There are 52 weeks in a year x 40 hours/week = 2,080 hours annually. Subtract Wendy’s additional paid time for the year:

• 6 holidays

• 10 vacation days

• 6 sick or personal days

• 4 days of training

Total additional paid time equals 28 days** (224 hours), leaving 1856 available hours of actually working.

Now let’s subtract an estimate of 2.5 hours from the 47 remaining work weeks for miscellaneous administrative meetings, timekeeping, general problem-solving or prep time and any other possible non-project tasks. This reduces the available production time by another 117.5 hours, leaving a total of 1,738.5 working hours remaining on projects, which will be your productive hours.

The final results of Wendy’s additional burden cost total is just over $20,000. This brings Wendy’s annual cost to $56,214.

Burden cost per actual productive hours for your company equals the annual cost of $56,214 / working hours of 1,738.5 resulting in $32.33 an hour. This is the bottom line to what Wendy is costing your company as a new hire per hour, which when computed as a percent comes to 90% added to Wendy’s base hourly rate.

*These addition cost will vary depending on company, state, full-time or part-time benefits. This is based off the average from Bureau of Labor Statistics, IRS and Better Business Bureau.

**Again these additional paid time days will vary depending on company policies and benefits established.

Ok. Now let’s look at an example of what hiring an Applied professional would cost.

Based off the same principles and the above example of the breakdown used in hiring a new employee, here is an example of an Applied customer’s annual cost and burden percent.

Download the Free Technical White Paper showing more details on Why Applied Consulting is cheaper than hiring a new employee.

If you have any questions Contact Us Today.